Adani Wilmar Share Price:

Introduction

Adani Wilmar is a prominent player in the Indian agribusiness industry and one of the largest edible oil manufacturers in the country. Established as a joint venture between the Adani Group and Wilmar International, the company has experienced significant growth and success since its inception. In this article, we will delve into the history, business operations, and market position of Adani Wilmar. Additionally, we will analyze its share price performance, considering various factors that may have influenced its valuation over time.

Company Background

Adani Wilmar’s story began in 1999 when the Adani Group, a diversified conglomerate with interests in ports, logistics, power generation, and agribusiness, joined hands with Wilmar International, a Singapore-based agribusiness group with a global presence. The joint venture aimed to leverage their expertise and resources to create a leading player in the Indian edible oil industry.

Business Operations and Product Portfolio

Adani Wilmar operates across various segments of the edible oil value chain. The company is primarily engaged in the manufacturing and marketing of edible oils, fats, and related products. Its product portfolio includes a wide range of edible oils, such as soybean oil, sunflower oil, palm oil, groundnut oil, and rice bran oil, among others.

The company also offers specialty oils for specific culinary and industrial applications. Additionally, Adani Wilmar produces and markets vanaspati, which is extensively used in the preparation of Indian sweets and snacks.

Market Presence and Distribution Network

Adani Wilmar has built a robust distribution network that spans the length and breadth of India. This expansive network enables the company to reach consumers in urban and rural areas alike. Adani Wilmar’s products are available through retail outlets, modern trade stores, and e-commerce platforms.

The company’s emphasis on quality, coupled with its strong distribution presence, has helped it gain a significant market share in the Indian edible oil industry. Adani Wilmar has earned the trust of consumers, and its brands have become synonymous with purity and reliability.

Key Factors Driving Growth

Strategic Partnerships: Adani Wilmar’s joint venture structure with Wilmar International has been a key enabler of its growth. Wilmar’s global expertise in the agribusiness sector and access to a vast supply chain network have provided Adani Wilmar with a competitive edge.

Brand Equity: The company has successfully built strong brand equity for its products over the years. Brands like Fortune, King’s, and Jubilee have become household names, further fueling the company’s market penetration.

Product Diversification: Adani Wilmar’s diverse product portfolio allows it to cater to different consumer preferences and demands. This diversification helps reduce risks associated with dependence on a single product category.

Focus on Quality and Innovation: The company’s commitment to maintaining high-quality standards has resonated well with consumers. Additionally, Adani Wilmar has invested in product innovation to stay relevant in a dynamic market.

Distribution Network: The extensive distribution network enables Adani Wilmar to reach consumers in both urban and rural areas, giving it a significant advantage over competitors.

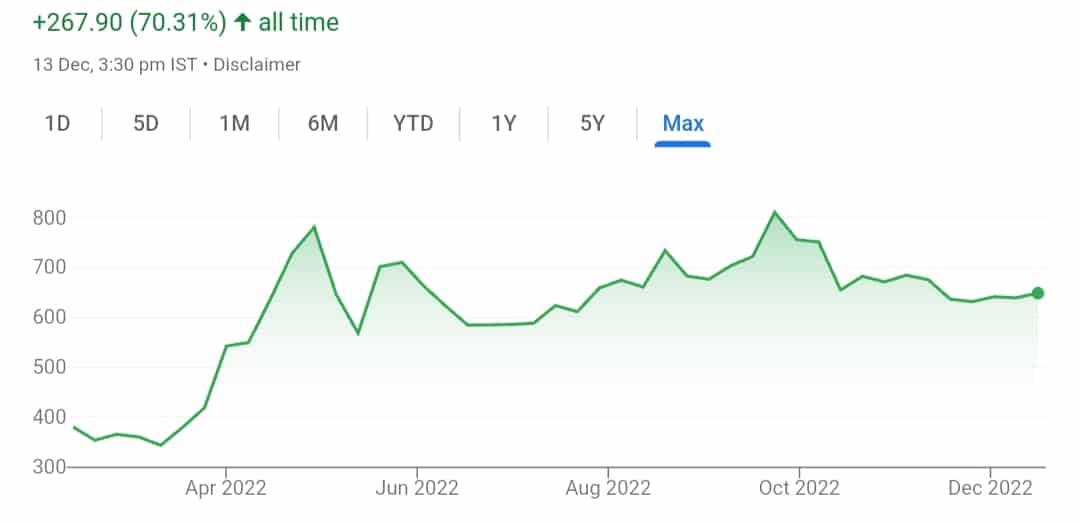

Share Price Performance Analysis

Analyzing the historical share price performance of Adani Wilmar provides insights into the company’s financial health, growth trajectory, and investors’ sentiment. However, it’s essential to consider that share prices are influenced by various factors, including market sentiment, macroeconomic conditions, industry dynamics, and company-specific developments.

1. Early Growth and Market Recognition

Upon its inception, Adani Wilmar experienced steady growth, driven by strategic partnerships, strong brand building, and a well-established distribution network. During this phase, the share price exhibited a gradual upward trajectory, reflecting investor confidence in the company’s growth prospects.

2. Fluctuations and External Factors

Like many companies in the market, Adani Wilmar’s share price has experienced fluctuations influenced by external factors. Macroeconomic conditions, changes in government policies, and fluctuations in commodity prices, particularly for edible oils, have impacted the company’s performance and share price movements.

3. Expansion and New Ventures

As Adani Wilmar continued to strengthen its market presence, it explored expansion opportunities into new product categories and geographical regions. Such expansions often sparked interest among investors, leading to short-term spikes in the share price.

4. Financial Performance

The financial performance of Adani Wilmar is a crucial determinant of its share price movement. Investors closely monitor revenue growth, profitability, and cash flow generation to gauge the company’s financial health. Strong financial results have historically translated into positive momentum for the share price.

5. Mergers and Acquisitions

Inorganic growth strategies, such as mergers and acquisitions, can significantly impact a company’s share price. Successful acquisitions or joint ventures can open new growth avenues and enhance market confidence, positively influencing share prices.

6. Industry Trends

Developments in the edible oil industry and changing consumer preferences have also influenced Adani Wilmar’s share price. Consumer trends, such as increased awareness of health and wellness, have led to a shift in demand for healthier cooking oils, prompting companies to adapt their product offerings.

Conclusion

Adani Wilmar’s journey from a joint venture to becoming a leading player in the Indian edible oil industry is a testament to its strategic vision, business acumen, and focus on quality. The company’s consistent growth, strong distribution network, and commitment to innovation have driven its success and market recognition.

While the share price of Adani Wilmar has experienced fluctuations over time, it is essential to recognize that the stock market is subject to numerous external factors and sentiments. Investors must carefully consider the company’s financial performance, industry dynamics, and management decisions when evaluating its share price potential.

As Adani Wilmar continues its growth trajectory, investors and stakeholders will closely monitor its performance, looking for signals of sustainable growth and market leadership in the agribusiness sector.

(Note: The information provided in this article is based on the knowledge available up to September 2021. For the most current data and developments related to Adani Wilmar, readers are encouraged to refer to the latest financial reports, news articles, and official company statements.)